ny paid family leave tax withholding

Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will. What Is Ny Paid Family Leave Tax.

New Ny Paid Family Leave Tax To Be Deducted From Employee S Paychecks Starting July 1 2017 R Nyc

1 Obtain Paid Family Leave coverage.

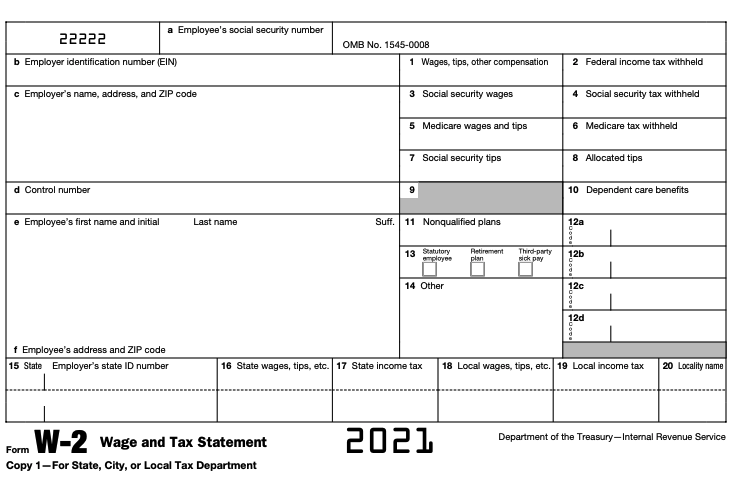

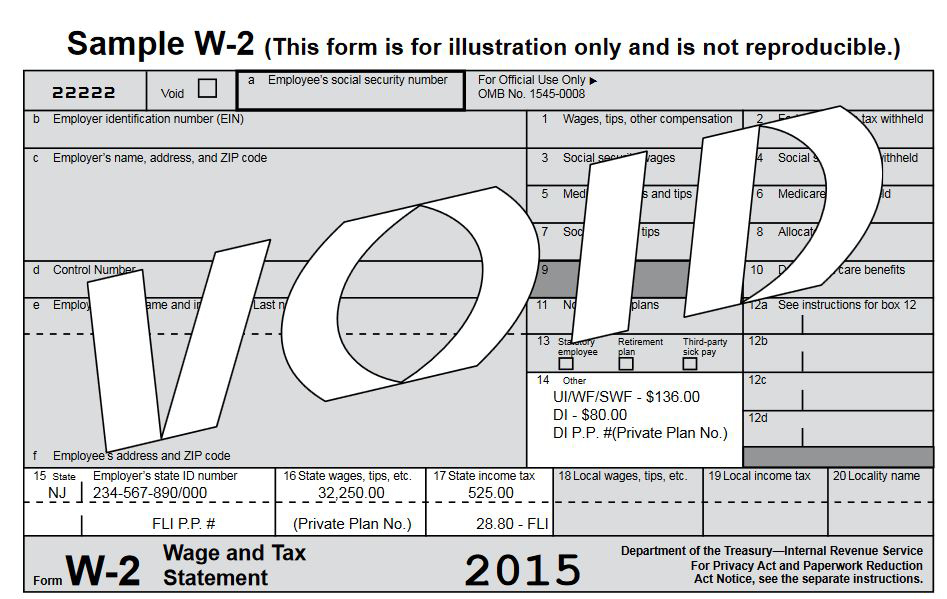

. The maximum annual contribution is 42371. Enhanced Disability and Paid Family Leave Benefits. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14.

State disability needs to be reported separately from the Paid Family Leave in box 14 of Form. Your insurance carrier may provide options for how you will be paid for example via direct deposit debit card or paper check. 518-485-6654 Paid family leave In 2016 Governor Cuomo signed the nations strongest and most comprehensive Paid Family.

Now after further review the New York Department of Taxation and. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. New York Paid Family Leave employer questions answered.

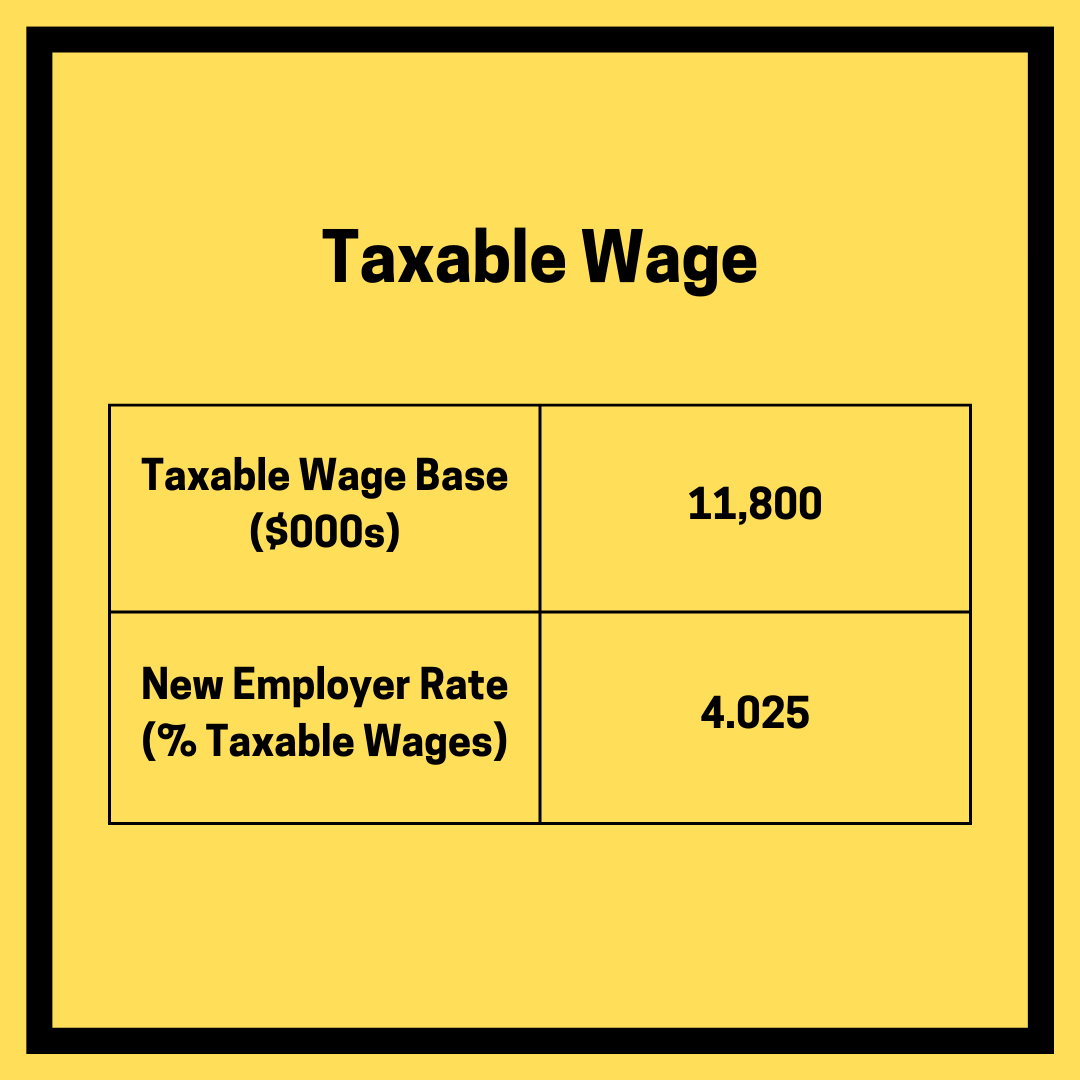

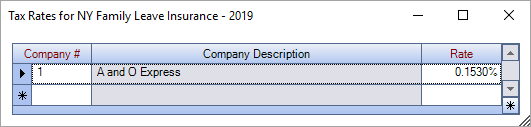

Wwwtaxnygov Withholding Tax Information. Paid Family Leave provides eligible employees job-protected paid time off to. For 2018 the PFL contribution rate is 0126 percent capped according to the New York State Average Weekly Wage.

For 2018 the annual cap is 8556 0126 percent of the annualized. Your employer will deduct premiums for the Paid Family Leave program from your. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Pursuant to the Department of Tax Notice No. For New York State withholding tax purposes. 2 Collect employee contributions to pay for their.

2022 Paid Family Leave Payroll Deduction Calculator. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program. The program is effective on January 1.

2021 Paid Family Leave Rate. Increased monetary pay out a shorter waiting period duration to. No deductions for PFL are taken from a businesses tax contributions.

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. Pursuant to the Department of Tax Notice No. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New. New York paid family leave benefits are taxable contributions must be made on after-tax basis. Employees can request voluntary tax withholding.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross. 2021 Paid Family Leave Rate Increase. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

An employer may choose to provide enhanced benefits such as. Somers NY group insurance agency. They are however reportable as.

New York designed Paid Family Leave to be easy for employers to implement with three key tasks. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. Wwwtaxnygov Withholding Tax Information Center.

After discussions with the Internal Revenue Service and its review of other legal. 518-485-6654 Paid family leave In 2016 Governor Cuomo signed the nations strongest and most comprehensive Paid Family. The contribution remains at just over half of one percent of an employees gross.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period. The New York Paid Family Leave Program was discussed in earlier posts on August 31 2017 August 17 2017 and June 29 2017.

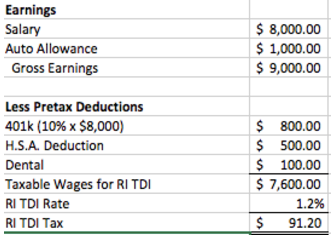

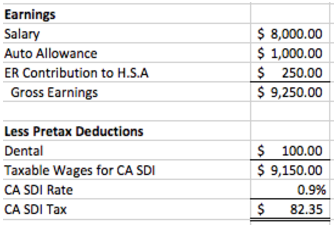

How Are State Disability Insurance Sdi Payroll Taxes Calculated

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

How Are State Disability Insurance Sdi Payroll Taxes Calculated

New York Paid Family Leave Resource Guide

The Next Big Question On New York Paid Family Leave How Do We Determine Tax Obligations

State Tax Withholding How It Can Vary What You Should Know Payroll Vault

A Complete Guide To New York Payroll Taxes

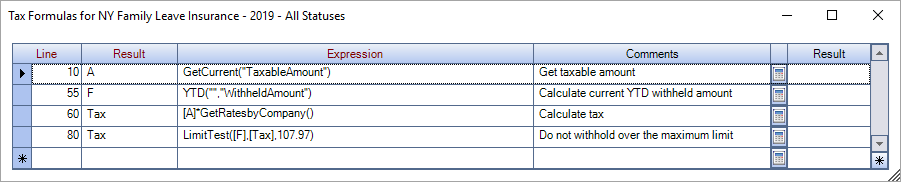

Setting Up New York Paid Family Leave

New York Payroll Services And Regulations Gusto Resources

Setting Up New York Paid Family Leave

Ma Pfml Claims Faq Usable Life

How To Read Your W 2 Justworks Help Center

New York Paid Family Leave Resource Guide

A Complete Guide To New York Payroll Taxes

Nj Division Of Taxation Common Filing Mistakes

Time Off To Care State Actions On Paid Family Leave

Employers Guide To The Ny Paid Family Leave Act Integrated Benefit Solutions