closed end funds leverage risk

In fact the Nuveen fund has a 38. Leverage the ability of closed-end funds to issue debt or raise money through the sale of preferred shares is a unique feature of closed-end funds.

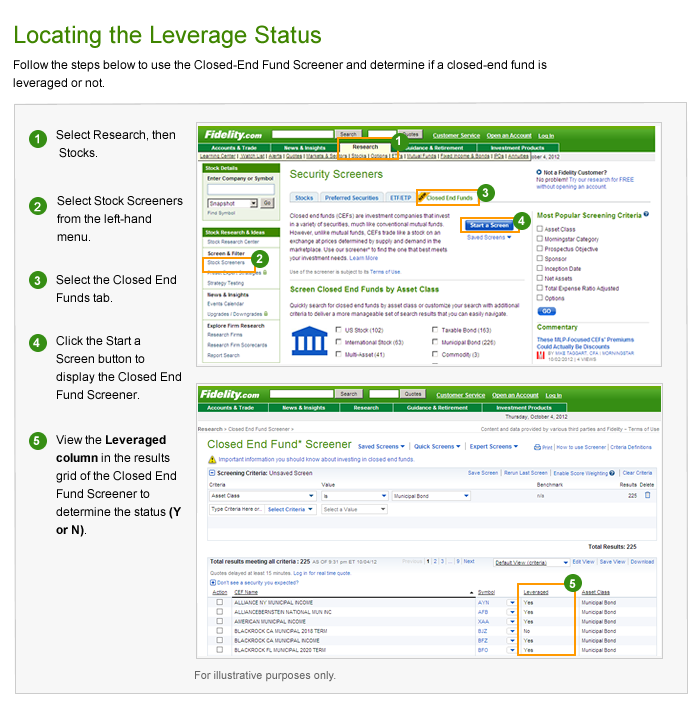

Closed End Fund Leverage Fidelity

If interest rate costs get too high the fund will be forced to cut the dividend.

. The authors demonstrate that the debt of closed-end. The use of leverage by a closed-end fund can allow it to achieve higher long-term returns but also increases risk and the likelihood of share price volatility. The use of leverage is subject to risks including the potential for higher net asset value NAV and market price volatility and.

BlackRock offerings include national and state specific funds. The extra risk closed-end funds are taking with leverage can certainly benefit investors on the upside but of course they can be penalized on the downside if things dont work out says. A lot of the funds in the closed-end fund space use leverage.

The following data show the 10 CEFs with the highest discounts and coverage 100. The negative side of the leverage knife can result in an investment death spiral for a highly leveraged closed-end fund. A closed-end fund manager does not have to hold excess cash to meet redemptions.

The fund can issue debt in an amount up to 50. Get this must-read guide if you are considering investing in mutual funds. In many cases leverage in these assets is viewed as a foregone conclusion what investors must accept in exchange for 8-12 distributions.

It can also increase risk and can make the price of closed-end fund. A fund that performs well in all market environments. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital.

Exposure to Leverage or Debt. Investors lost almost 6 in 2018 13 in 2013 and 23 in 2008. Data were taken from the close of May 27th 2022.

Closed-end funds use of leverage can increase your returns but can also increase your losses. Ad Learn why mutual funds may not be tailored to meet your retirement needs. Closed-end funds raise a certain amount of money through an initial public.

Most investors think theyre getting a bond fund with these closed end funds but these are not the safety you expect from bonds. Just like open-ended funds closed-end funds are subject to market movements and volatility. Total Assets of Closed-End Funds At year-end 2021 461 closed-end funds had total assets of 309 billionan increase of 98 percent from year-end 2020.

Primarily invest in tax-exempt municipal bonds and may utilize leverage to enhance income potential. Ad How this fund beats the SP in bull and bear markets. Closed-end funds create leverage by borrowing at short-term rates then using that money to invest in strategies or instruments providing longer-term returns.

Increasing leverage in a closed-end bond fund increases both its expected return and its standard deviation but does not increase its Sharpe ratio. Most closed funds use leverage borrowing to invest more than assets to boost their returns and distributions. Top 10 widest quality discounts.

What this means for you. Yields z-scores and. Not all closed-end funds use leverage but most bond CEFs do.

Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. Along the same lines consider the shares of the Nuveen Credit Strategies Income Fund JQC 654 when looking for.

Closed-end funds have emerged as a potential solution for retirees seeking to smooth out their cash flows and in turn soothe their shaken nerves. Leverage ratios limited by regulation ratings and risk management Municipal funds in high 30s Closed-End Fund Leverage Ratios Taxable funds range by sector cluster around 30 Ratios greater than regulatory limit use non-traditional funding Source. Structure has ability to buy illiquid assets with.

Diversified by asset strategy manager. The shock to the funding of closed-end funds led to an opportunity to explore the connections between funding liquidity risk and market prices. Just like discount risk leverage risk tends to amplify price volatility and underperformance in market sell-offs.

A closed-end fund or CEF is an investment company that is managed by an investment firm. Closed-end fund definition. Closed-end funds can produce higher income than open-end mutual funds.

The value of a CEF can decrease due to movements in the overall. Discounts and Leverage Risk in Downturns. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between 30 and 60.

With strict limits on leverage. Closed-end funds may use debt or other leverage more than other types of investment companies to purchase their investments. A closed end fund is a type of investment company whose shares are traded on the open market.

A closed-end fund manager does not face reinvestment risk from daily share issuance. The Funds use of leverage exposes the Fund to additional risks including the risk that the costs of leverage could exceed the income earned by the Fund on the proceeds of such leverage. Cutting the dividend will cause investors to dump shares leading to a declining share price.

And this was typically historically this has typically been from preferred shares. Like a mutual fund a closed-end fund is a pooled. For example if an unleveraged fund loses 100 in NAV a leveraged fund borrowing 050 on the 100 would lose 150.

Closed End Funds Definition Pros Cons Seeking Alpha

Understanding Leverage In Closed End Funds Nuveen

What Are Closed End Funds Fidelity

5 Best High Yielding Closed End Funds To Buy

What Is The Difference Between Closed And Open Ended Funds Quora

Investing In Closed End Funds Nuveen

Guide To Closed End Funds Money For The Rest Of Us

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Guide To Closed End Funds Money For The Rest Of Us

Understanding Leverage In Closed End Funds Nuveen

The Debt Time Bomb Facing Closed End Funds Barron S

What Are Mutual Funds 365 Financial Analyst

Understanding Leverage In Closed End Funds Nuveen

What Is The Difference Between Closed And Open Ended Funds Quora

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed End Funds Calamos Investments

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends